Getting My income tax To Work

If a taxpayer discovers an error with a return, or determines that tax to get a calendar year should be various, the taxpayer should really file an amended return. These returns represent claims for refund if taxes are decided to are overpaid.

Bracket adjustments might help stop taxpayers from ending up in the next tax bracket as their cost of living rises, a scenario termed “bracket creep." They might also lessen taxes for all those whose payment has not retained up with inflation.

NerdWallet has an engagement with Atomic Commit, LLC (“Atomic Make investments”), an SEC-registered expense adviser, to bring you the opportunity to open an financial investment advisory account (“Atomic Treasury account”). Financial commitment advisory products and services are furnished by Atomic Commit. Firms which can be engaged by Atomic Commit obtain compensation of 0% to 0.85% annualized, payable monthly, centered on property below management for every referred customer who establishes an account with Atomic Commit (i.e., actual payment will vary). Atomic Commit also shares a proportion of compensation received from margin interest and free hard cash desire acquired by consumers with NerdWallet. NerdWallet just isn't a client of Atomic Make investments, but our engagement with Atomic invest presents us an incentive to refer you to definitely Atomic Commit as opposed to An additional investment adviser.

We do not provide economical advice, advisory or brokerage services, nor do we suggest or recommend people today or to obtain or provide certain shares or securities. General performance information and facts may have changed since the time of publication. Past effectiveness will not be indicative of long run effects.

The federal govt and lots of states, in addition to neighborhood jurisdictions, levy their own personal income taxes.

Tax exempt entity returns are due four and just one fifty percent months following the entity's 12 months end. All federal returns may very well be prolonged with most extensions offered by merely submitting a single web page sort. Due dates and extension provisions for condition and local income tax returns range.

Some states also limit deductions by firms for investment connected costs. Company registration A lot of states allow for distinctive amounts for depreciation deductions. State restrictions on deductions may possibly vary noticeably from federal limitations.

Forbes Advisor adheres to rigid editorial integrity standards. To the ideal of our understanding, all information is correct as with the date posted, while delivers contained herein might no longer be out there.

The marginal tax fee is the tax amount paid on the final dollar of taxable income. It ordinarily equates to the highest tax bracket.

An individual pays tax in a given bracket only for Every single greenback within that tax bracket's assortment. The highest marginal rate will not implement in sure many years to specified different types of income. Considerably reduced premiums utilize following 2003 to funds gains and qualifying dividends (see underneath).

NerdWallet strives to keep its data exact and up-to-date. This data could be different than Whatever you see any time you stop by a monetary establishment, service supplier or distinct products's web site. All fiscal products and solutions, buying services and products are introduced without warranty.

Marginal tax fee[32] Single taxable income Married submitting jointly or experienced widow(er) taxable income Married filing independently taxable income Head of house taxable income

Major Marginal State Income Tax Withholding Costs 2022 Income tax is usually levied by most U.S. states and lots of localities on persons, corporations, estates, and trusts. These taxes are As well as federal income tax and so are deductible for federal tax purposes. State and native income tax premiums differ from zero to 16% of taxable income.

There are several federal tax principles made to prevent people today from abusing the tax process. Provisions connected with these taxes are frequently complex. These types of regulations contain:

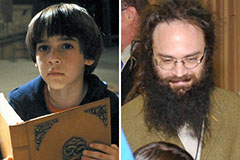

Barret Oliver Then & Now!

Barret Oliver Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!